when will capital gains tax increase uk

The proposal by House Democrats would also add a 3 percent tax for people with modified adjusted gross income above 5 million beginning in 2022 in addition to hiking the capital-gains tax rate to 15. Anything less than that is tax-free.

How To Avoid Capital Gains Tax On Rental Property In 2022

Taxes on the gain from selling other assets rise to 10 for taxpayers with basic tax rates and to 20 for taxpayers with higher.

. Those earning more than this amount are subject to a 20 percent tax rate. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 for most assets held for more. UK Capital Gains Tax.

As a US citizen or Green Card Holder receiving dividends in the UK is a unique situation. Five key ways you could slash your bill in 2022 capital gains tax cgt is estimated to collect some 20billion from the british public by the year 2027. The government could raise an extra 16bn a year if the low tax rates on profits from shares and property were increased and.

The rates for higher rate taxpayers are 20 and 28 respectively. The difference in income between 41401 and 445850 will result in a capital gains tax of 15 percent. When the Treasury introduced changes to the Entrepreneurs Relief now Business Asset Disposal Relief in the spring 2020 Budget the government outlined the proposed changes to the legislation some of which were effective from the Budget date 11 March 2020.

After selling an asset you only owe Capital Gains Tax on profits above 12300. In the event of a property sale if the sale resulted in capital gains tax the profits will be taxed at 18 on the sale value or 28 on the income if the sale resulted in capital gains tax. Its the gain you make thats taxed not the.

These reports suggest amendments to the existing system. The Government may reveal its. Putting the S in OTS.

Last modified on Tue 26 Oct 2021 1101 EDT. The increase would affect only about 03 of tax filers Deese said. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year.

In practice here are the deadlines to be aware of. Individuals have a personal allowance of 12300 a year meaning that no capital gains tax is payable on gains of less than this amount. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019-20. Make sure you do this by 31st January the tax year after you profit. Tue 26 Oct 2021 1100 EDT.

If capital gains tax rates were aligned with income tax rates the top rate of capital gains tax would increase to 45 percent in Britain. Tax rates on capital gains are set for 2021-22 and 2020-21. Theres talk of CGT capital gains tax increasing in the US if Biden gets in.

How much these gains are taxed depends a lot on how long you held the asset before selling. Six ways to reduce your CGT bill - use it or lose it AS THE end of the tax year looms Britons are reminded to check if. This article discusses the journey of capital gains tax CGT in the last.

In the last six months the Office of Tax Simplification OTS has published two reports evaluating the effectiveness of the capital gains taxation system in the UK. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay capital gains tax at. Or could the tax rate be retroactively applied to the 202122 tax year.

Profits from capital gains - assets like stocks - are taxed at a lower. Taxes united-kingdom capital-gains-tax capital-gain. Any capital gains exceeding this amount will be subject to US tax.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of. 2 days agoHeres a peek at the 2022 short-term capital gains rates for those who break up with their stocks early. Also included is the provision to raise the highest marginal rate of.

Have you heard of any potential CGT increases in the UK. This allowance is the amount before any tax is payable. Yes so I think capital gains tax potentially will increase.

When you earn more than 12300 during a tax year you will need to declare it to HMRC and file a tax return. The changes will be effective from the new tax year starting 6 April 2021. Capital Gains Tax Allowance 2022 Scotland Capital Gains Tax Allowance 2022 Scotland.

Another one from Alan. Capital Gains Tax. Trustees have half the personal allowance so currently 6150.

He told the Telegraph. If you dont do this you could face a fine from hmrcTax Data Card 202223 RossMartincouk from rossmartincoukIn 2022 the capital gains tax. You know at the end of the day its a tax on profits they are actually realised profits.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. 2 days agoIndividual filers for example wont pay capital gains tax in 2021 if they have total taxable income 40400 or less during that same year. This is simply because we updated our tax calculators based on user feedback we tailor the germany salary calculator to suit our users needs.

Once again no change to CGT rates was announced which actually came as no surprise. 2022 Capital Gains Tax Uk. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10.

2022 And 2021 Capital Gains Tax Rates Smartasset

Guide To Capital Gains Tax Times Money Mentor

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Https You 38degrees Org Uk Petitions Increase Tax On Unearned Assets Like Shares And Second Homes Bucket Email Blas Budgeting Open Letter Business Investment

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

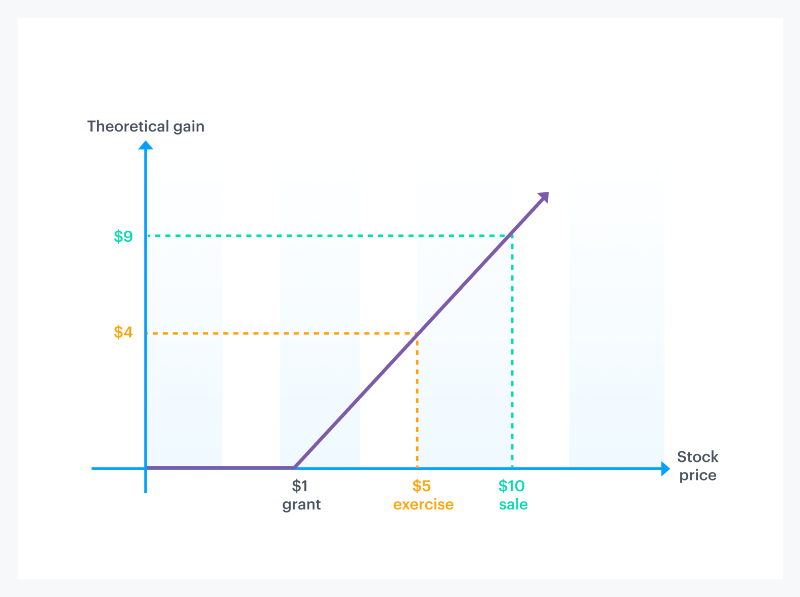

How Stock Options Are Taxed Carta

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

2022 And 2021 Capital Gains Tax Rates Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Biden S Capital Gains Tax Hike Could Spark A Big Sell Off In Stocks Here S What That Means For The Market Capital Gains Tax Capital Gain Economic Analysis

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

The Capital Gains Tax And Inflation Econofact

Do I Have To Pay Capital Gains Tax When I Gift A Property The Telegraph In 2022 Capital Gains Tax Capital Gain Setting Up A Trust

When Does Capital Gains Tax Apply Taxact Blog

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool